Money Laundering Placement Layering Integration Definition

The idea of money laundering is essential to be understood for these working in the financial sector. It is a course of by which dirty cash is transformed into clear money. The sources of the money in actual are legal and the cash is invested in a method that makes it seem like clear money and hide the identity of the prison a part of the cash earned.

While executing the financial transactions and establishing relationship with the new clients or sustaining current clients the obligation of adopting sufficient measures lie on every one who is a part of the group. The identification of such aspect to start with is straightforward to deal with as an alternative realizing and encountering such situations afterward within the transaction stage. The central bank in any country offers complete guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously provide enough safety to the banks to deter such conditions.

These phases are called placement layering and integration. The stages of money laundering include the.

Understanding Money Laundering European Institute Of Management And Finance

Placement layering and integration stage.

Money laundering placement layering integration definition. The money laundering cycle can be broken down into three distinct stages. Placement layering and integration. There are three acknowledged phases to money laundering.

It is important to mix the funds from illegal sources with legalIt is relatively very difficult to detect money laundering at this stage. Here are some of the most common ways this is achieved. Second phase involves mixing the funds.

The placement stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. The Placement Stage Filtering. Placement layering and integration.

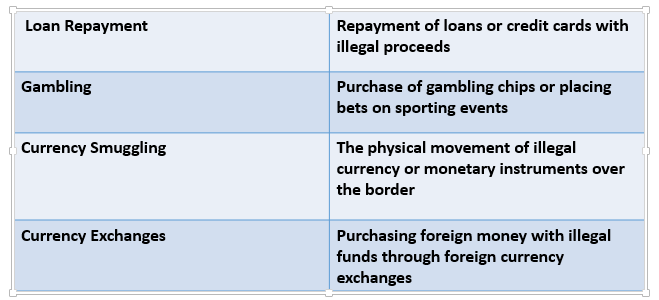

Cash generated from crime is placed in the financial system. There are many ways of money laundering which are. The money laundering process begins after criminals acquire illegal funds from criminal activity and seek to introduce them into the legitimate financial system.

Layering can include changing the nature of the assets ie. Money laundering has one purpose. Definition of Money Laundering.

The money laundering process is divided into 3 segments. Placement Layering and Integration. Some common methods of laundering are.

Placement layering integration blah blah blah Out of obscurity Unnecessary complexity clouds both the definition of money laundering and understanding of the role and capabilities of financial intelligence units so limiting their potential contribution. There are usually two or three phases to the laundering. However the broader definition of money laundering offences in POCA includes even passive possession of criminal property as money laundering.

Cash gold casino chips real-estate etc. This stage is termed as placement. The money laundering process most commonly occurs in three key stages.

However it is important to remember that money laundering is a single process. This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. Money laundering involves concealing the act of transforming profits earned from corruption and illegal activities into legitimate assets.

In the third stage money flows back to the beneficiary. To turn the proceeds of crime into cash or property that looks legitimate and can be used without suspicion. The money appears to be from normal business or trade earnings.

These three steps may be performed individually or simultaneously. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the. The goal of layering is to make the process of tracking money through each layer more difficult to accomplish.

Money laundering refers to the process by which individuals disguise the original ownership and control of proceeds through making such proceeds appear to be legitimately ownedacquired. The three stages of money laundering are as follows. And at the same time hiding its source.

A simpler definition of money laundering would be a series of financial transactions that intend to transform ill-gotten gains into legitimate money or other assets. Layering and Placement Pre-Layering. The first stage of money laundering is known as placement whereby dirty money is placed into the legal.

There are three stages involved in money laundering. Accordingly the first stage of the money laundering process is known as placement. Placement layering and integration.

Money Laundering Placement Layering Integration three stages. In this stage money comes back to owner or criminal from the sources appearing to be legitimate and is integrated into the financial system. Each individual money laundering stage can be extremely complex due to the criminal activity involved.

At this stage the dirty money that has come from illegal activities is entered into a legitimate financial system. Complex layering schemes involve sending the money. Placement is the first stage of money laundering.

Process of Money Laundering. Notable money laundering scandal. Placement is the first stage of the money laundering process and is the stage during which money is most vulnerable to detection and seizure.

The three steps of laundering money are. Placement is the first step of money laundering which is the process of moving the money into the legitimate source via financial institutions casinos financial instruments etc. Money laundering typically includes three stages.

An example of placement can be placing the funds in a bank account to begin the cleaning process. The final stage in money laundering cycle is INTEGRATION.

Money Laundering Typology Through Business Structures Entities An Overview From Company Law Perspective Sudut Pikir

How To Prevent Illegal Money Laundering Activities In Bitcoin Exchange Business Money Laundering Anti Money Laundering Law Bitcoin

Anti Money Laundering Overview Process And History

Cryptocurrency Money Laundering Explained Bitquery

What Is Money Laundering Three Methods Or Stages In Money Laundering

Money Laundering Examples Chaussureslouboutin Soldes Fr

Process Of Money Laundering Placement Layering Integration

Economic Crime Institute Conference Find The Fraudstermoney Launderer

What Is Anti Money Laundering Aml Anti Money Laundering

The Phases Of Money Laundering Download Scientific Diagram

3 Stages Of Money Laundering Techniques Anti Money Laundering

Cams Afroza Money Laundering And Terrorist Financing Overview

Process Of Money Laundering Placement Layering Integration

The world of regulations can look like a bowl of alphabet soup at instances. US money laundering rules are no exception. We have compiled an inventory of the highest ten money laundering acronyms and their definitions. TMP Risk is consulting agency focused on defending financial providers by lowering risk, fraud and losses. We have now massive financial institution expertise in operational and regulatory threat. Now we have a powerful background in program administration, regulatory and operational threat as well as Lean Six Sigma and Enterprise Course of Outsourcing.

Thus money laundering brings many opposed consequences to the organization because of the dangers it presents. It increases the likelihood of major risks and the opportunity price of the bank and finally causes the financial institution to face losses.

Comments

Post a Comment